Finally, when the product is sold, the sale is recorded at the sale price, while the cost is transferred from finished goods inventory to the cost of goods sold expense account. Figure 4.19 shows the flow of costs from raw materials inventory to cost of goods sold. At all points in the process, the work in process should include the cost of direct materials and direct labor.

Would you prefer to work with a financial professional remotely or in-person?

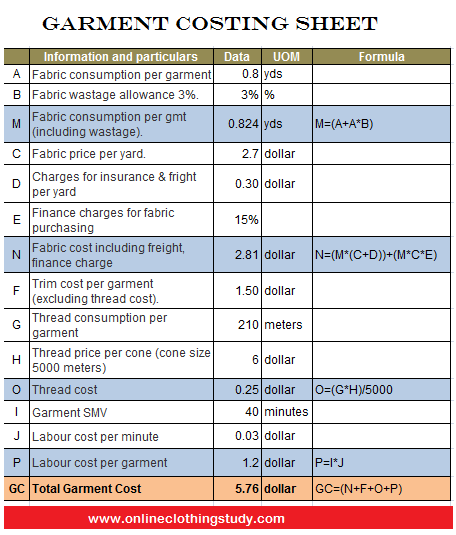

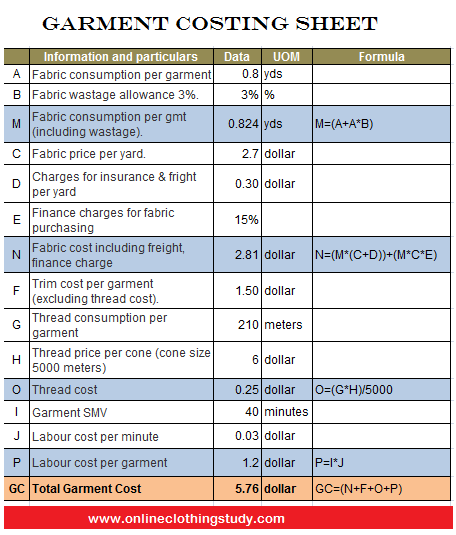

You also estimate that your employees involved will work 10,000 hours in 2025. For a construction business, direct material costs would include raw materials such as lumber, wiring, screws, and more, as well as indirect material that is not used in the finished product, like office and cleaning supplies. You may choose to add a margin to these materials to cover other related costs, including wastage or delivery fees. The amounts in raw materials, work in process, and finished goods inventories compose the total cost for each account, whereas the job cost sheets contain the costs for each individual job. A summary of the jobs for Dinosaur Vinyl is given in Figure 4.21. Job costing is an important accounting process to go through after one job is complete, determining the actual costs of the job, including direct labor cost, material cost, and overhead, and what the revenue was.

OpenStax

- Job costing, also called project-based accounting, is the process of tracking costs and revenue for each individual project.

- You may choose to add a margin to these materials to cover other related costs, including wastage or delivery fees.

- The total cost of a job is ascertained by posting all costs related to that job to the job cost sheet.

- Thus, it serves as an authority to the foreman to indicate that the work should be started.

Performing an analysis that looks into job inefficiencies can help you make changes now that will positively affect your business in the future. This may include reducing the number of employees contracted onto any given job, retraining those who are underperforming, or promoting employees who work more efficiently than others. Although it may feel like extra work you do not want to add to your staff’s plate, calculating project costs after the job is complete is a worthwhile endeavor. Someone on our team will connect the target cost for a job using job costing is calculated as: you with a financial professional in our network holding the correct designation and expertise. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Our Team Will Connect You With a Vetted, Trusted Professional

When the job is completed and overhead assigned, the overhead allocation increases the cost of the work in process inventory. The cost of each individual job is maintained on a job cost sheet, and the total of all the work in process job cost sheets equals the work in process inventory and the statement of cost of goods manufactured, as you have learned. Overhead is the most difficult cost to calculate because you’ll need to rely on an approximation instead of the actual cost. You’ll need to accurately estimate the total overhead costs factoring into the job, including rent on your office, administrative costs, and depreciation, or machine hours, on the equipment used. Many small businesses apply a blanket overhead fee to each project, such as 10 percent per job. An accountant can help you analyze your business and develop a specific approach to overhead.

Determining the Costs of an Individual Job Using Job Order Costing

Under job costing, production is undertaken by a manufacturer against a customer’s order and not for stock. It is a type of costing used to figure out how much it costs a business to manufacture a small batch of unique items for a customer. Some examples include personalized t-shirts for a team, props used for filmmaking, or law firms calculating what to charge clients. A job cost sheet is a subsidiary ledger that identifies the individual costs for each job.

The responsibility of preparing the BOM lies with the production planning department. The foreman receives a copy of the BOM along with the production order. The production order takes the form of instructions issued to a foreman to proceed with the job. When an order for a job is received and accepted by the manufacturer, the order, as well as the job, is given a specific number. Job costing is suitable in organizations that perform work according to customer specifications. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License .

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. 11 Financial is a registered investment adviser located in Lufkin, Texas.

While job costing is useful in many cases, it also entails more clerical work and can be expensive, utilizing software and careful tracking. It cannot account for unexpected costs, and it may not be useful for fast-paced and cost-efficient jobs. Distribution Companies and Transportation Providers – Gas, vehicle maintenance, and the direct labor cost of drivers are all important costs of running these businesses. You also need to include insurance costs, licensing fees, and logistics management, all of which factor into running a profitable business. To record all the direct and indirect costs incurred in the completion of each job, the costing department should prepare a job cost card or job cost sheet.

Job costing looks at each project in detail, breaking down the costs of labor hours, materials, and overhead. Creating a job cost sheet helps companies stay profitable by taking stock of how much past jobs have cost, allowing business owners to make changes to improve efficiency and reduce costs. Process costing is only used in the case of mass production of a product, determining the unit cost per item. Any type of business can benefit from job costing, from construction companies to accounting firms. Accounting software can help you keep track of receipts, stay on track with your financial goals, and ensure you are getting paid what you are worth. In job costing, the cost is maintained for each job or product by calculating all expenses, including materials, labor, and overheads.